- [Korean]

-

Analysis of pork consumption attribute factors by consumer lifestyle in Korea: a cross-sectional study

-

Jounghee Lee, Juhyun Lee, Wookyoung Kim

-

Korean J Community Nutr 2025;30(1):75-88. Published online February 28, 2025

-

DOI: https://doi.org/10.5720/kjcn.2024.00332

-

-

Abstract Abstract

PDF PDF

- Objectives

This study aims to identify and analyze how different South Korean lifestyles impact attitudes towards pork consumption.

Methods

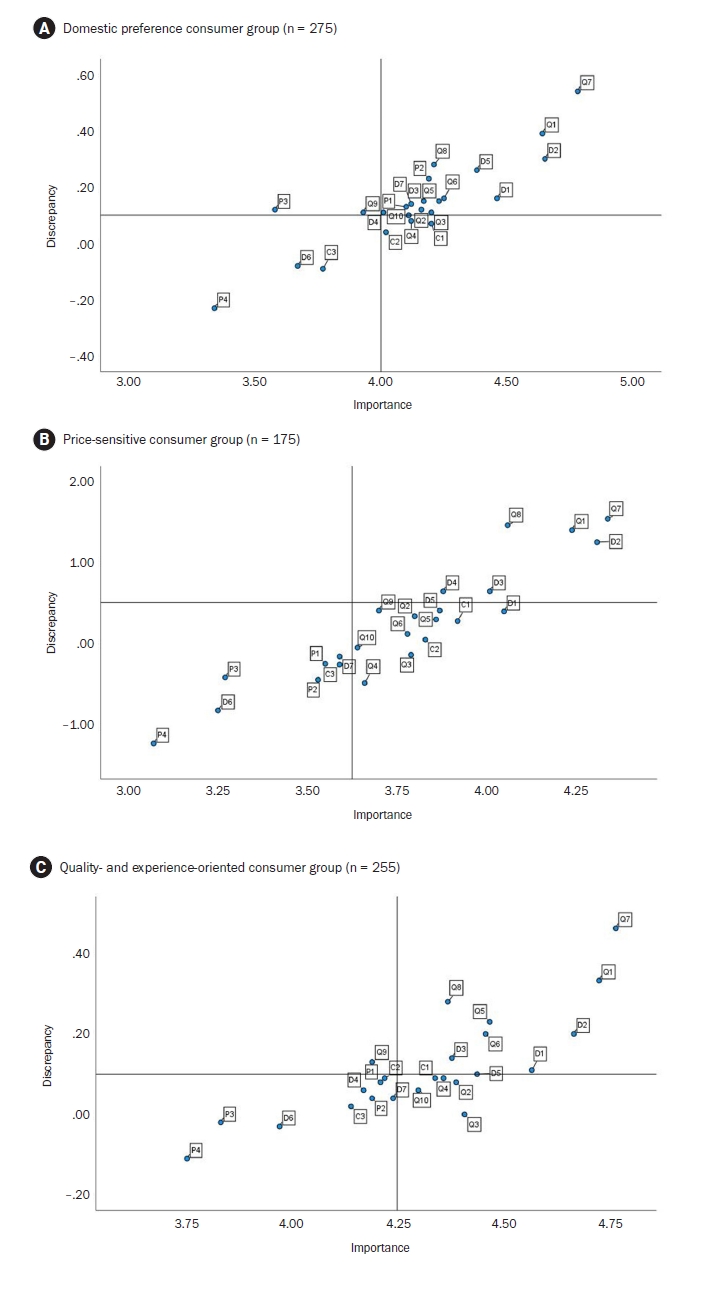

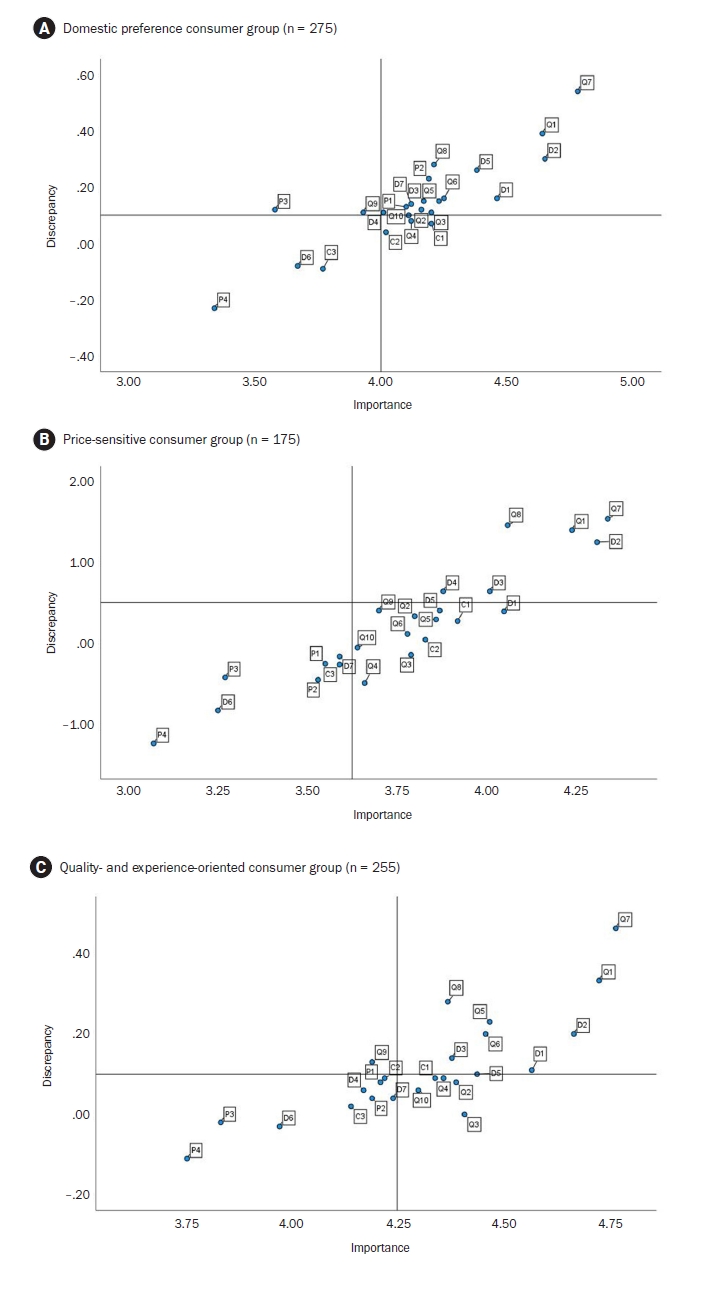

We implemented a cross-sectional survey targeting 705 adult consumers in South Korea using hierarchical and K-means cluster analyses. Respondents were classified into three relevant lifestyles: (1) domestic preference, (2) price-sensitive, and (3) quality-experience-oriented. The importance-performance analysis was employed to evaluate discrepancies between how they rated pork consumption using factors of “importance” and “satisfaction”. We employed Borich’s needs assessment and the Locus for Focus model to prioritize management areas.

Results

The research findings highlight that unpleasant odor/smell (Q7) and hygiene (Q1) were common key areas for management across all consumer groups, emphasizing their importance in enhancing pork consumption satisfaction. Among the groups, the domestic preference group showed high importance-performance discrepancies in attributes like expiry date (D2), suggesting a need for strengthened trust in domestic pork distribution and information transparency. The price-sensitive group prioritized economic factors, with fat thickness (Q8) identified as an essential management area. The quality-experience-oriented group emphasized sensory qualities such as juiciness (Q6) and meat color (Q5), with off-flavors (Q7) displaying the largest discrepancy. These results show the significant role of sensory attributes in consumer satisfaction.

Conclusion

This study demonstrated the multidimensional nature of pork consumption behavior, emphasizing the need for tailored strategies across consumer groups. Managing hygiene (Q1) and reducing off-flavors (Q7) are critical for all segments, while group-specific strategies include managing sensory quality for the quality-experience-oriented group, providing product information (D2) to increase trust for the domestic preference group, and emphasizing value for money for the price-sensitive group.

|